A Tennessee small estate affidavit facilitates the distribution of an uncomplicated estate to the heir(s) of a deceased individual by expediting the probate process. This affidavit is reserved for relatively modest estates valued at $50,000 or less and may not be used to transfer real property. Tennessee law states that forty-five (45) days must pass after the decedent’s death before this affidavit may be filed. The deceased person’s beneficiaries or heirs may be able to petition the court to reduce this waiting period (§ 30-4-103(1)(C)).

The small estate affidavit may administer the estate of a decedent as long as the total value of the personal property does not exceed $50,000, forty-five (45) days have passed since the decedent died, and no petition has been filed for the appointment of a personal representative.

The forty-five (45) day waiting period may be circumvented if the court is petitioned by a devisee named in the will or the decedent’s next of kin or heirs (if no will).

The beneficiaries or personal representative named in the will may appoint any adult to complete the affidavit as long as all parties consent. If no will was left, the heirs or next of kin may appoint an affiant to file the affidavit.

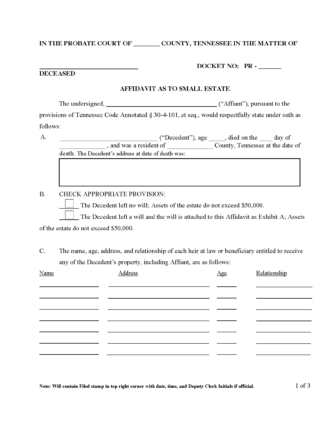

Once the waiting period has passed, the appointed affiant may complete the Affidavit as to Small Estate. The affidavit must include the following:

Once complete, the affiant may file the affidavit with the Probate Court in the county where the decedent lived.

Once the affidavit has been filed and approved by the court, the clerk will provide the affiant with certified copies of the affidavit with the clerk’s stamp and seal. The affiant may then be required to secure a bond payable to the state equal to the value of the estate. This is to ensure they fulfill their duties in distributing the estate on behalf of the heirs. The clerk may not require bond under the following circumstances:

The affiant will be automatically released from the bond liability one (1) year after the filing of the affidavit, or if they provide another affidavit to the court that states all the decedent’s debt was paid.

The certified copies affidavit may be used by the affiant to gather the property of the decedent from its custodians and distribute it accordingly to the heirs.