Subcontractor Agreement Template

A subcontractor agreement is between a contractor and a subcontractor that is hired to complete a task that is part of a larger project. The subcontractor is considered a 1099 independent contractor, not an employee, which means they are liable for the payment of their own Federal and State withholding taxes. A subcontractor is not owed or entitled to anything other than the monetary amount by the hiring contractor. The agreement should include the scope of work, payment details, and upon signing by both parties becomes a legally binding document.

By State

By Type (14)

- Business Associate (HIPAA)

- Cleaning (Residential and Commercial)

- Construction/ Contractor

- Consulting

- Electrician

- Graphic Design

- Installation

- Interior Design

- Painting

- Roofing

- Software Development

- Snow Plow / Removal

- Truck Driver

- Web Design

Table of Contents

- Subcontractor Agreements: By State

- Subcontractor Agreements: By Type

- How to Write a Subcontractor Agreement

How to Write a Subcontractor Agreement

1 – Acquire Your Copy Of The Subcontractor Contract Documenting A Project Agreement

The “Adobe PDF” or “Microsoft Word” version of the Subcontractor Agreement (displayed in the preview) are accessible through the blue buttons with these labels. You may download either or both depending upon your preferences.

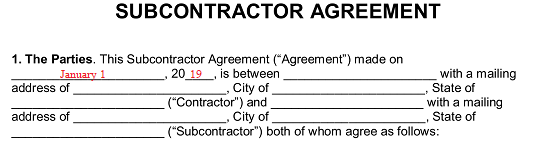

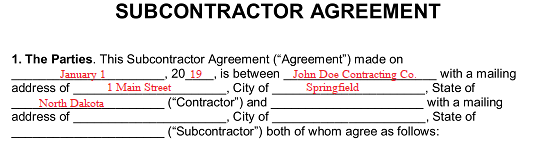

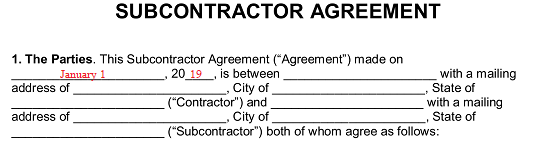

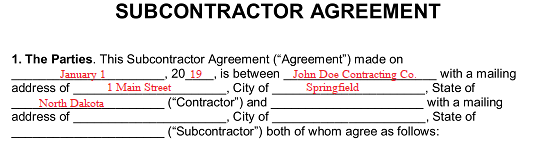

2 – Identify Both The Contractor And Subcontractor Agreeing To This Arrangement

Once you have accessed your copy of this agreement, open it then locate the first article. All articles in this document will be designated with a number and bold wording. Article “1. The Parties” will begin this document by requiring you attach an exact calendar date to it. This information should be entered as a month, day, then year on the first three blank lines.  The next task necessary for this introductory statement is to identify the Contractor with the Contractor’s business name and mailing address. The wording of this sentence will require information to be broken down across several entries using four specific blank lines. Start by reporting the Contractor’s business name on the first line after the phrase “…Is Between” then continue by producing the Contractor’s mailing address as the street address, city, and state on the next three lines that follow (concluding with the label “Contractor”).

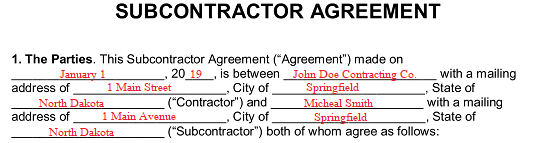

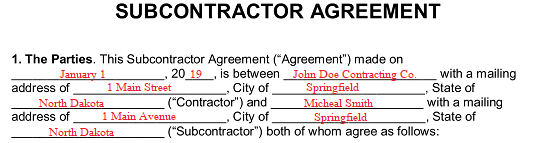

The next task necessary for this introductory statement is to identify the Contractor with the Contractor’s business name and mailing address. The wording of this sentence will require information to be broken down across several entries using four specific blank lines. Start by reporting the Contractor’s business name on the first line after the phrase “…Is Between” then continue by producing the Contractor’s mailing address as the street address, city, and state on the next three lines that follow (concluding with the label “Contractor”).  The Subcontractor who the Contractor above intends to commission must be attached to this document. Satisfy this necessity by submitting his or her full professional name on the first line after the word “..And” then his or her full professional mailing address across the remaining lines in this statement.

The Subcontractor who the Contractor above intends to commission must be attached to this document. Satisfy this necessity by submitting his or her full professional name on the first line after the word “..And” then his or her full professional mailing address across the remaining lines in this statement.

3 – Discuss The Client, Required Services, And The Subcontractor’s Obligations

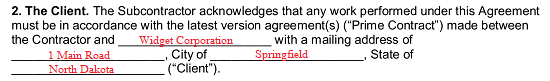

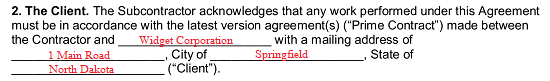

In the second article (“2. The Client”) we will identify the Contractor’s Client by name and mailing address. This material should also be presented across four blank lines and should be reported exactly as it was recorded in the Contractor’s agreement with his or her Client.

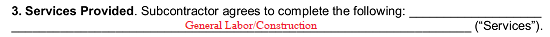

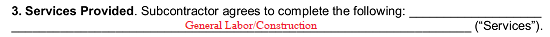

We will discuss the “Services Provided” to the Client by the Contractor in the third article. There will be an area presented just before the parentheses labeled “Services” where you can summarize what the Contractor was hired to do. If a contract was involved and will be attached then make sure to present its name as well.

We will discuss the “Services Provided” to the Client by the Contractor in the third article. There will be an area presented just before the parentheses labeled “Services” where you can summarize what the Contractor was hired to do. If a contract was involved and will be attached then make sure to present its name as well.  Naturally, we must address what services the Subcontractor is being hired to provide. Several checkbox definitions have been supplied in the fourth article, “Subcontractor Responsibilities,” You may check one, some, or all of these checkboxes. The Subcontractor in our example will be hired for general labor, thus we shall check the first checkbox “Labor” and leave the others unmarked.

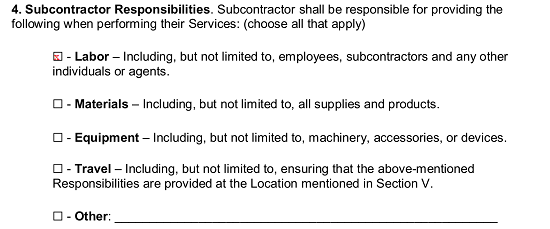

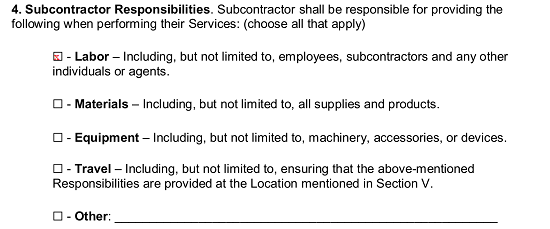

Naturally, we must address what services the Subcontractor is being hired to provide. Several checkbox definitions have been supplied in the fourth article, “Subcontractor Responsibilities,” You may check one, some, or all of these checkboxes. The Subcontractor in our example will be hired for general labor, thus we shall check the first checkbox “Labor” and leave the others unmarked.

4 – Define Where The Subcontractor Must Work, The Compensation Involved, And When This Must Occur

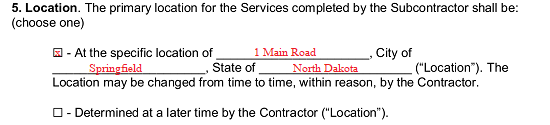

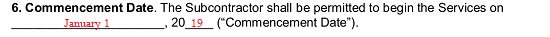

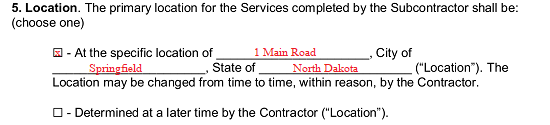

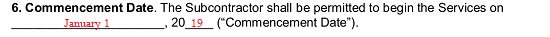

The article labeled with the words “5. Location” will solidify where the Contractor expects the Subcontractor to appear for work. This can be quickly achieved by marking one of the two checkbox statements here. If the Contractor has a “…Specific Location…” then mark the first checkbox and record the street address, city, and state where the Subcontractor must work on the three blank spaces in this choice. However, if the worksite will be defined in the future by the Contractor, mark the second checkbox. In the example, we have chosen a specific place of work.  After we have solidified where the Subcontractor’s work must take place we should deliver the first calendar date he or she must begin working on the project. “6. Commencement Date” will supply the two empty lines in the format required to deliver this information.

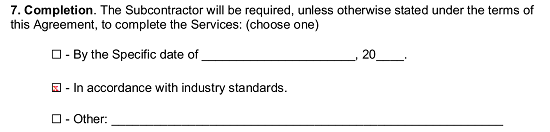

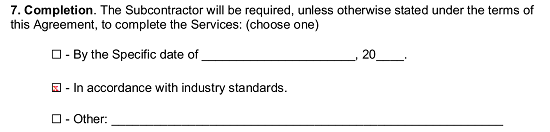

After we have solidified where the Subcontractor’s work must take place we should deliver the first calendar date he or she must begin working on the project. “6. Commencement Date” will supply the two empty lines in the format required to deliver this information.  In addition to the first calendar date of work for the Subcontractor, we must document what is considered the successful “Completion” of this project (in the seventh article). Here, you must choose one of three statements to apply. If the Subcontractor’s part in the project will naturally terminate on a specific calendar date, then mark the first checkbox and record the date where requested. If this is not accurate, the next choice will allow the “…Industry Standards” to define when this project will be deemed complete while the third is available to employ once you mark it and directly type in the conditions of completion on the blank line provided.

In addition to the first calendar date of work for the Subcontractor, we must document what is considered the successful “Completion” of this project (in the seventh article). Here, you must choose one of three statements to apply. If the Subcontractor’s part in the project will naturally terminate on a specific calendar date, then mark the first checkbox and record the date where requested. If this is not accurate, the next choice will allow the “…Industry Standards” to define when this project will be deemed complete while the third is available to employ once you mark it and directly type in the conditions of completion on the blank line provided.

5 – Document The Subcontractor’s Pay For This Project

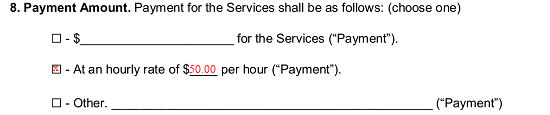

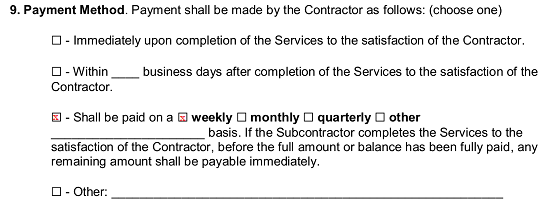

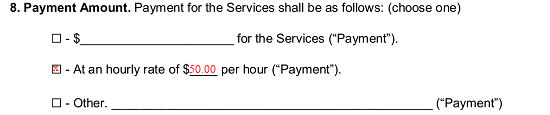

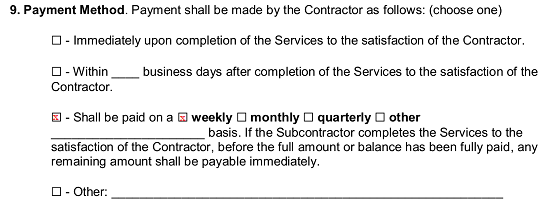

Our next topic will be that of Subcontractor’s compensation. Choose one of the three statements in “8. Payment Amount” to document how much the Contractor must pay the Subcontractor. The first statement will allow you to define a whole dollar amount for the entire project by reporting it directly on the blank line attached to the dollar sign, the second statement will define the pay as a dollar amount per hour once you record this dollar amount on the blank line provided, while the third choice will give a space to customize your description of the Subcontractor’s pay. Mark the checkbox that corresponds to the statement that best represents how much the Subcontractor will receive and enter the content required to it. Notice below that the Subcontractor will be paid hourly.  The way the Contractor will be required to pay the Subcontractor will also be included in this paperwork. The following section, “9. Payment Method,” will give four checkbox statements you may choose from to provide this information. The first statement requires the Contractor to pay the Subcontractor once the Contractor deems the work complete and satisfactory, the second statement will allow the Contractor a grace period (in business days) after the project has been finished to pay the Subcontractor, the third one will enable you to report a periodic payment schedule for the duration of the project, while the fourth will simply present a blank line you may use to give a more appropriate description of the means of payment. If you choose the third statement, be prepared to mark the “Weekly,” “Monthly,” “Quarterly,” or “Other” checkbox to define this period. See the example below.

The way the Contractor will be required to pay the Subcontractor will also be included in this paperwork. The following section, “9. Payment Method,” will give four checkbox statements you may choose from to provide this information. The first statement requires the Contractor to pay the Subcontractor once the Contractor deems the work complete and satisfactory, the second statement will allow the Contractor a grace period (in business days) after the project has been finished to pay the Subcontractor, the third one will enable you to report a periodic payment schedule for the duration of the project, while the fourth will simply present a blank line you may use to give a more appropriate description of the means of payment. If you choose the third statement, be prepared to mark the “Weekly,” “Monthly,” “Quarterly,” or “Other” checkbox to define this period. See the example below.

6 – Further Define Some Of The Responsibilities And Limitations Of The Subcontractor

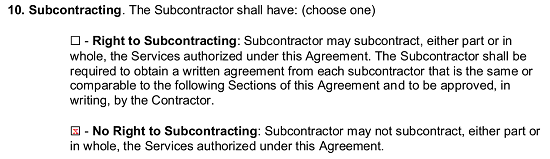

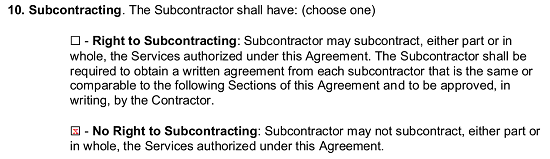

In some cases, the scope of the Contractor’s project may require the participation of multiple parties. If the Subcontractor will be allowed to hire additional parties for any of the services required here then mark the first checkbox in the tenth article “Subcontracting.” If not, mark the second checkbox as in the image below.  Mark the first checkbox in “11. Assignment” if the Subcontractor may assign any of the rights afforded by this contract to another party. If not, then mark the second checkbox in this article.

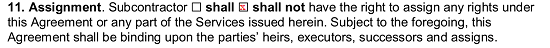

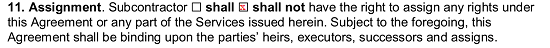

Mark the first checkbox in “11. Assignment” if the Subcontractor may assign any of the rights afforded by this contract to another party. If not, then mark the second checkbox in this article.  Some projects will necessitate that the Subcontractor carries insurance. If so mark the first checkbox in “12. Insurance,” then continue to part “A. Coverage Types.” If the Contractor does not require the Subcontractor to be insured for this project then mark the second checkbox (“Shall Not”) then proceed to the next article.

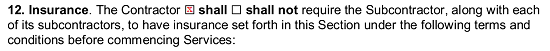

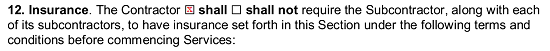

Some projects will necessitate that the Subcontractor carries insurance. If so mark the first checkbox in “12. Insurance,” then continue to part “A. Coverage Types.” If the Contractor does not require the Subcontractor to be insured for this project then mark the second checkbox (“Shall Not”) then proceed to the next article.  If the Subcontractor must carry one or more insurance policies in order to satisfy the requirements of this contract, then we must declare address the checkboxes in “A. Coverage Types.” Thus, if the Subcontractor is required to maintain “General Liability Insurance,” mark the first checkbox and proceed to report the required policy amounts on the blank lines in items “A.)” through “D.)” (i.e. Combined Single Limit, Personal Liability, Aggregate For Products-Completed Operations, and General Aggregate). Similarly, if the Subcontractor must carry “Vehicle Liability Insurance,” “Excess Liability Insurance,” and/or have an “Additional Insurance Requirement” to uphold you must mark the box corresponding to that statement label. Keep in mind that you will need to report the minimum insurance policy coverage if you have checked either “Vehicle Liability Insurance” or “Excess Liability Insurance.” A blank line has been provided to both in case such a report is necessary.

If the Subcontractor must carry one or more insurance policies in order to satisfy the requirements of this contract, then we must declare address the checkboxes in “A. Coverage Types.” Thus, if the Subcontractor is required to maintain “General Liability Insurance,” mark the first checkbox and proceed to report the required policy amounts on the blank lines in items “A.)” through “D.)” (i.e. Combined Single Limit, Personal Liability, Aggregate For Products-Completed Operations, and General Aggregate). Similarly, if the Subcontractor must carry “Vehicle Liability Insurance,” “Excess Liability Insurance,” and/or have an “Additional Insurance Requirement” to uphold you must mark the box corresponding to that statement label. Keep in mind that you will need to report the minimum insurance policy coverage if you have checked either “Vehicle Liability Insurance” or “Excess Liability Insurance.” A blank line has been provided to both in case such a report is necessary.

7 – Define Options Both Parties May Take If A Dispute Arises

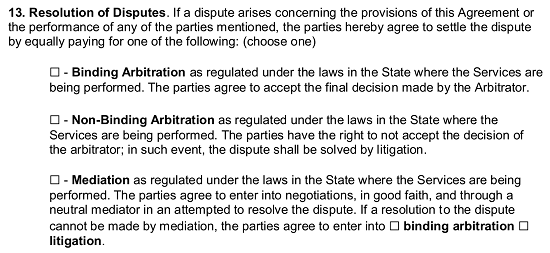

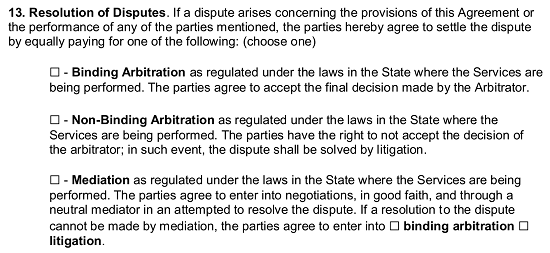

If a disagreement regarding this contract arises (whether anticipated or not), there should be a course of action set in place through this agreement to guide the two participants. You must select the appropriate statement in “13. Resolution Of Disputes” to solidify this course. Here, the Contractor and Subcontractor may participate in “Binding Arbitration,” “Non-Binding Arbitration,” or “Mediation” as per this agreement once you mark the checkbox corresponding to the agreed-upon course of action.  The next article requiring your attention, “14. Termination,” also seeks to handle any objections either Party may have to the completion of this contract’s term. If neither Party retains the right to terminate this agreement, then mark the first checkbox in this statement.

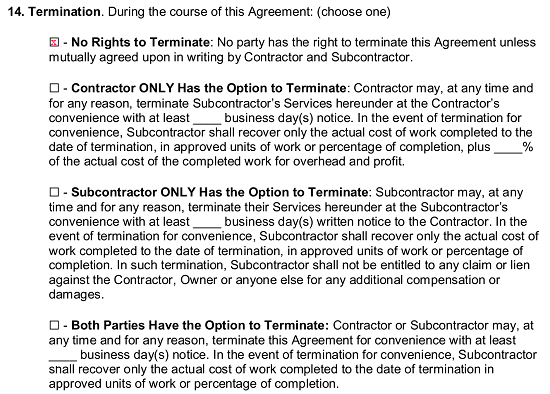

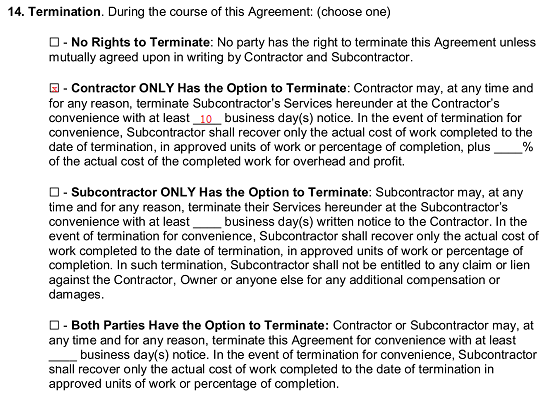

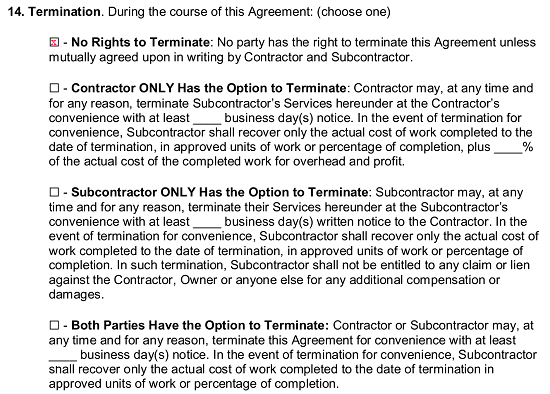

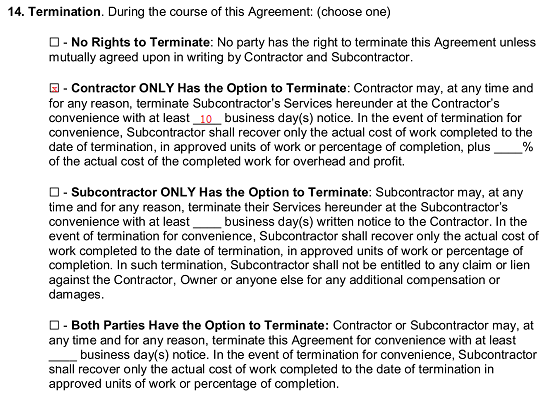

The next article requiring your attention, “14. Termination,” also seeks to handle any objections either Party may have to the completion of this contract’s term. If neither Party retains the right to terminate this agreement, then mark the first checkbox in this statement.  If only the Contractor has the right to terminate this agreement then, select the second checkbox. Continue in this selection by entering the number of (business) days’ notice he or she must give the Subcontractor on the first blank line and the percentage of the cost of completed work (in addition to any paid amount) to the second blank line. (Keep in mind this percentage will only apply if this Contractor cancels this agreement as a matter of convenience.

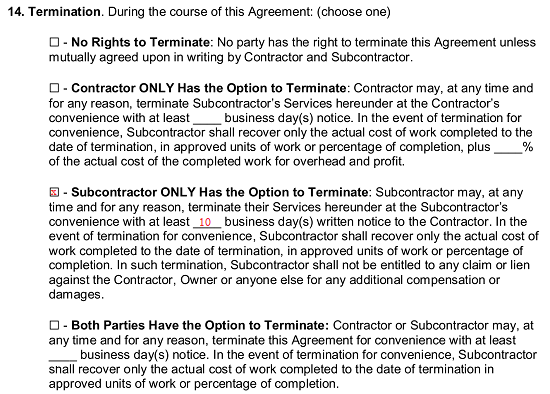

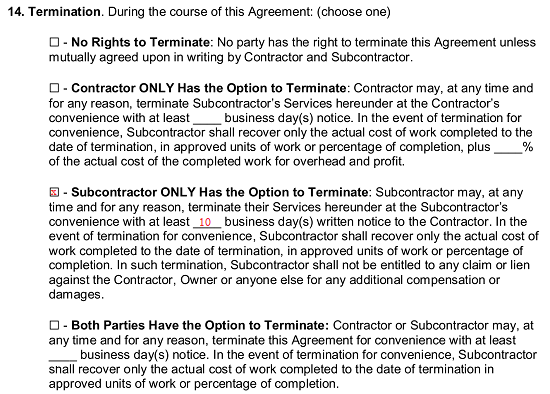

If only the Contractor has the right to terminate this agreement then, select the second checkbox. Continue in this selection by entering the number of (business) days’ notice he or she must give the Subcontractor on the first blank line and the percentage of the cost of completed work (in addition to any paid amount) to the second blank line. (Keep in mind this percentage will only apply if this Contractor cancels this agreement as a matter of convenience.  If only the Subcontractor has the “…Option To Terminate” this agreement then mark the third checkbox and report the number of days’ notice (business days) that must be issued before termination.

If only the Subcontractor has the “…Option To Terminate” this agreement then mark the third checkbox and report the number of days’ notice (business days) that must be issued before termination.  Both the Contractor and Subcontractor may retain the right to end this agreement prematurely so long as you mark the fourth checkbox then enter how many business days’ notice must be issued to the remaining Party on the blank line provided. Before a dispute officially exists one or both parties must claim that one exists. This claim must be accompanied with a timeline to correct the offending action in the form of a notice. Record how many days’ the violating Party would have to cure a grievance on the blank line in “15. Claims.”

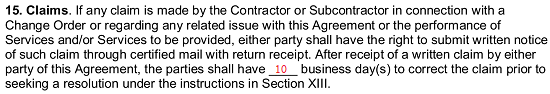

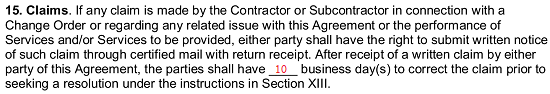

Both the Contractor and Subcontractor may retain the right to end this agreement prematurely so long as you mark the fourth checkbox then enter how many business days’ notice must be issued to the remaining Party on the blank line provided. Before a dispute officially exists one or both parties must claim that one exists. This claim must be accompanied with a timeline to correct the offending action in the form of a notice. Record how many days’ the violating Party would have to cure a grievance on the blank line in “15. Claims.”  Document which state shall govern this agreement on the empty line in the thirtieth article (“30. Governing Law”).

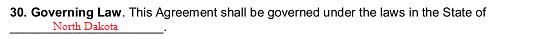

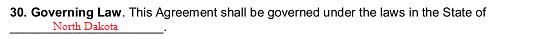

Document which state shall govern this agreement on the empty line in the thirtieth article (“30. Governing Law”).  It is important that all aspects of the agreement the Contractor and Subcontractor wish to be documented have been accurately presented within the contents of this paperwork. Article “32. Additional Provisions” will enable you to satisfy this need nicely by providing the space to report any additional topics, limits, restrictions, requirements, or conditions either or both parties must adhere to. If more space is required then furnish all this information to an attachment(s) and reference it by name on the blank lines provided.

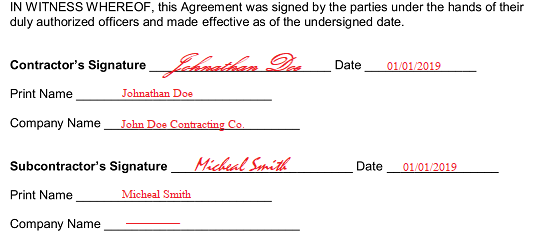

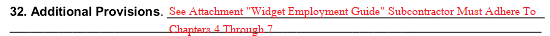

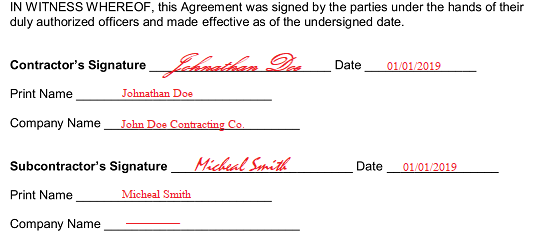

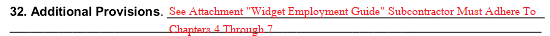

It is important that all aspects of the agreement the Contractor and Subcontractor wish to be documented have been accurately presented within the contents of this paperwork. Article “32. Additional Provisions” will enable you to satisfy this need nicely by providing the space to report any additional topics, limits, restrictions, requirements, or conditions either or both parties must adhere to. If more space is required then furnish all this information to an attachment(s) and reference it by name on the blank lines provided.  The Contractor must now review the completed paperwork. If its contents accurately represent the agreement he or she intends to enter with the Subcontractor then the Contractor must sign the “Contractor’s Signature” line and submit the signature “Date.” Additionally, the Contractor must print his or her name below this and report the legal identity of his or her business on the “Company Name” line.

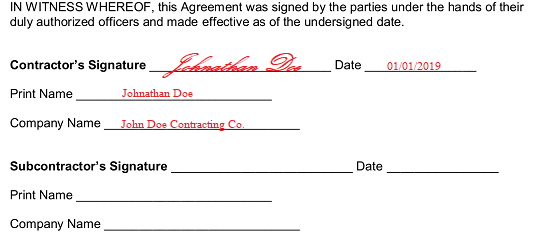

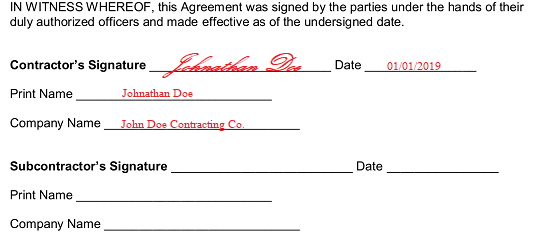

The Contractor must now review the completed paperwork. If its contents accurately represent the agreement he or she intends to enter with the Subcontractor then the Contractor must sign the “Contractor’s Signature” line and submit the signature “Date.” Additionally, the Contractor must print his or her name below this and report the legal identity of his or her business on the “Company Name” line.  The Subcontractor must now read through this paperwork and determine whether it fully defines the working arrangement he or she intends to engage in with the Contractor. If so, then the Subcontractor must sign and date this contract on the “Subcontractor’s Signature” line and “Date” line respectively. This entity will also need to provide his or her printed name and professional name on the “Print Name” and “Company Name” line.

The Subcontractor must now read through this paperwork and determine whether it fully defines the working arrangement he or she intends to engage in with the Contractor. If so, then the Subcontractor must sign and date this contract on the “Subcontractor’s Signature” line and “Date” line respectively. This entity will also need to provide his or her printed name and professional name on the “Print Name” and “Company Name” line.

The next task necessary for this introductory statement is to identify the Contractor with the Contractor’s business name and mailing address. The wording of this sentence will require information to be broken down across several entries using four specific blank lines. Start by reporting the Contractor’s business name on the first line after the phrase “…Is Between” then continue by producing the Contractor’s mailing address as the street address, city, and state on the next three lines that follow (concluding with the label “Contractor”).

The next task necessary for this introductory statement is to identify the Contractor with the Contractor’s business name and mailing address. The wording of this sentence will require information to be broken down across several entries using four specific blank lines. Start by reporting the Contractor’s business name on the first line after the phrase “…Is Between” then continue by producing the Contractor’s mailing address as the street address, city, and state on the next three lines that follow (concluding with the label “Contractor”).  The Subcontractor who the Contractor above intends to commission must be attached to this document. Satisfy this necessity by submitting his or her full professional name on the first line after the word “..And” then his or her full professional mailing address across the remaining lines in this statement.

The Subcontractor who the Contractor above intends to commission must be attached to this document. Satisfy this necessity by submitting his or her full professional name on the first line after the word “..And” then his or her full professional mailing address across the remaining lines in this statement.

We will discuss the “Services Provided” to the Client by the Contractor in the third article. There will be an area presented just before the parentheses labeled “Services” where you can summarize what the Contractor was hired to do. If a contract was involved and will be attached then make sure to present its name as well.

We will discuss the “Services Provided” to the Client by the Contractor in the third article. There will be an area presented just before the parentheses labeled “Services” where you can summarize what the Contractor was hired to do. If a contract was involved and will be attached then make sure to present its name as well.  Naturally, we must address what services the Subcontractor is being hired to provide. Several checkbox definitions have been supplied in the fourth article, “Subcontractor Responsibilities,” You may check one, some, or all of these checkboxes. The Subcontractor in our example will be hired for general labor, thus we shall check the first checkbox “Labor” and leave the others unmarked.

Naturally, we must address what services the Subcontractor is being hired to provide. Several checkbox definitions have been supplied in the fourth article, “Subcontractor Responsibilities,” You may check one, some, or all of these checkboxes. The Subcontractor in our example will be hired for general labor, thus we shall check the first checkbox “Labor” and leave the others unmarked.

After we have solidified where the Subcontractor’s work must take place we should deliver the first calendar date he or she must begin working on the project. “6. Commencement Date” will supply the two empty lines in the format required to deliver this information.

After we have solidified where the Subcontractor’s work must take place we should deliver the first calendar date he or she must begin working on the project. “6. Commencement Date” will supply the two empty lines in the format required to deliver this information.  In addition to the first calendar date of work for the Subcontractor, we must document what is considered the successful “Completion” of this project (in the seventh article). Here, you must choose one of three statements to apply. If the Subcontractor’s part in the project will naturally terminate on a specific calendar date, then mark the first checkbox and record the date where requested. If this is not accurate, the next choice will allow the “…Industry Standards” to define when this project will be deemed complete while the third is available to employ once you mark it and directly type in the conditions of completion on the blank line provided.

In addition to the first calendar date of work for the Subcontractor, we must document what is considered the successful “Completion” of this project (in the seventh article). Here, you must choose one of three statements to apply. If the Subcontractor’s part in the project will naturally terminate on a specific calendar date, then mark the first checkbox and record the date where requested. If this is not accurate, the next choice will allow the “…Industry Standards” to define when this project will be deemed complete while the third is available to employ once you mark it and directly type in the conditions of completion on the blank line provided.

The way the Contractor will be required to pay the Subcontractor will also be included in this paperwork. The following section, “9. Payment Method,” will give four checkbox statements you may choose from to provide this information. The first statement requires the Contractor to pay the Subcontractor once the Contractor deems the work complete and satisfactory, the second statement will allow the Contractor a grace period (in business days) after the project has been finished to pay the Subcontractor, the third one will enable you to report a periodic payment schedule for the duration of the project, while the fourth will simply present a blank line you may use to give a more appropriate description of the means of payment. If you choose the third statement, be prepared to mark the “Weekly,” “Monthly,” “Quarterly,” or “Other” checkbox to define this period. See the example below.

The way the Contractor will be required to pay the Subcontractor will also be included in this paperwork. The following section, “9. Payment Method,” will give four checkbox statements you may choose from to provide this information. The first statement requires the Contractor to pay the Subcontractor once the Contractor deems the work complete and satisfactory, the second statement will allow the Contractor a grace period (in business days) after the project has been finished to pay the Subcontractor, the third one will enable you to report a periodic payment schedule for the duration of the project, while the fourth will simply present a blank line you may use to give a more appropriate description of the means of payment. If you choose the third statement, be prepared to mark the “Weekly,” “Monthly,” “Quarterly,” or “Other” checkbox to define this period. See the example below.

Mark the first checkbox in “11. Assignment” if the Subcontractor may assign any of the rights afforded by this contract to another party. If not, then mark the second checkbox in this article.

Mark the first checkbox in “11. Assignment” if the Subcontractor may assign any of the rights afforded by this contract to another party. If not, then mark the second checkbox in this article.  Some projects will necessitate that the Subcontractor carries insurance. If so mark the first checkbox in “12. Insurance,” then continue to part “A. Coverage Types.” If the Contractor does not require the Subcontractor to be insured for this project then mark the second checkbox (“Shall Not”) then proceed to the next article.

Some projects will necessitate that the Subcontractor carries insurance. If so mark the first checkbox in “12. Insurance,” then continue to part “A. Coverage Types.” If the Contractor does not require the Subcontractor to be insured for this project then mark the second checkbox (“Shall Not”) then proceed to the next article.  If the Subcontractor must carry one or more insurance policies in order to satisfy the requirements of this contract, then we must declare address the checkboxes in “A. Coverage Types.” Thus, if the Subcontractor is required to maintain “General Liability Insurance,” mark the first checkbox and proceed to report the required policy amounts on the blank lines in items “A.)” through “D.)” (i.e. Combined Single Limit, Personal Liability, Aggregate For Products-Completed Operations, and General Aggregate). Similarly, if the Subcontractor must carry “Vehicle Liability Insurance,” “Excess Liability Insurance,” and/or have an “Additional Insurance Requirement” to uphold you must mark the box corresponding to that statement label. Keep in mind that you will need to report the minimum insurance policy coverage if you have checked either “Vehicle Liability Insurance” or “Excess Liability Insurance.” A blank line has been provided to both in case such a report is necessary.

If the Subcontractor must carry one or more insurance policies in order to satisfy the requirements of this contract, then we must declare address the checkboxes in “A. Coverage Types.” Thus, if the Subcontractor is required to maintain “General Liability Insurance,” mark the first checkbox and proceed to report the required policy amounts on the blank lines in items “A.)” through “D.)” (i.e. Combined Single Limit, Personal Liability, Aggregate For Products-Completed Operations, and General Aggregate). Similarly, if the Subcontractor must carry “Vehicle Liability Insurance,” “Excess Liability Insurance,” and/or have an “Additional Insurance Requirement” to uphold you must mark the box corresponding to that statement label. Keep in mind that you will need to report the minimum insurance policy coverage if you have checked either “Vehicle Liability Insurance” or “Excess Liability Insurance.” A blank line has been provided to both in case such a report is necessary.

The next article requiring your attention, “14. Termination,” also seeks to handle any objections either Party may have to the completion of this contract’s term. If neither Party retains the right to terminate this agreement, then mark the first checkbox in this statement.

The next article requiring your attention, “14. Termination,” also seeks to handle any objections either Party may have to the completion of this contract’s term. If neither Party retains the right to terminate this agreement, then mark the first checkbox in this statement.  If only the Contractor has the right to terminate this agreement then, select the second checkbox. Continue in this selection by entering the number of (business) days’ notice he or she must give the Subcontractor on the first blank line and the percentage of the cost of completed work (in addition to any paid amount) to the second blank line. (Keep in mind this percentage will only apply if this Contractor cancels this agreement as a matter of convenience.

If only the Contractor has the right to terminate this agreement then, select the second checkbox. Continue in this selection by entering the number of (business) days’ notice he or she must give the Subcontractor on the first blank line and the percentage of the cost of completed work (in addition to any paid amount) to the second blank line. (Keep in mind this percentage will only apply if this Contractor cancels this agreement as a matter of convenience.  If only the Subcontractor has the “…Option To Terminate” this agreement then mark the third checkbox and report the number of days’ notice (business days) that must be issued before termination.

If only the Subcontractor has the “…Option To Terminate” this agreement then mark the third checkbox and report the number of days’ notice (business days) that must be issued before termination.  Both the Contractor and Subcontractor may retain the right to end this agreement prematurely so long as you mark the fourth checkbox then enter how many business days’ notice must be issued to the remaining Party on the blank line provided. Before a dispute officially exists one or both parties must claim that one exists. This claim must be accompanied with a timeline to correct the offending action in the form of a notice. Record how many days’ the violating Party would have to cure a grievance on the blank line in “15. Claims.”

Both the Contractor and Subcontractor may retain the right to end this agreement prematurely so long as you mark the fourth checkbox then enter how many business days’ notice must be issued to the remaining Party on the blank line provided. Before a dispute officially exists one or both parties must claim that one exists. This claim must be accompanied with a timeline to correct the offending action in the form of a notice. Record how many days’ the violating Party would have to cure a grievance on the blank line in “15. Claims.”  Document which state shall govern this agreement on the empty line in the thirtieth article (“30. Governing Law”).

Document which state shall govern this agreement on the empty line in the thirtieth article (“30. Governing Law”).  It is important that all aspects of the agreement the Contractor and Subcontractor wish to be documented have been accurately presented within the contents of this paperwork. Article “32. Additional Provisions” will enable you to satisfy this need nicely by providing the space to report any additional topics, limits, restrictions, requirements, or conditions either or both parties must adhere to. If more space is required then furnish all this information to an attachment(s) and reference it by name on the blank lines provided.

It is important that all aspects of the agreement the Contractor and Subcontractor wish to be documented have been accurately presented within the contents of this paperwork. Article “32. Additional Provisions” will enable you to satisfy this need nicely by providing the space to report any additional topics, limits, restrictions, requirements, or conditions either or both parties must adhere to. If more space is required then furnish all this information to an attachment(s) and reference it by name on the blank lines provided.  The Contractor must now review the completed paperwork. If its contents accurately represent the agreement he or she intends to enter with the Subcontractor then the Contractor must sign the “Contractor’s Signature” line and submit the signature “Date.” Additionally, the Contractor must print his or her name below this and report the legal identity of his or her business on the “Company Name” line.

The Contractor must now review the completed paperwork. If its contents accurately represent the agreement he or she intends to enter with the Subcontractor then the Contractor must sign the “Contractor’s Signature” line and submit the signature “Date.” Additionally, the Contractor must print his or her name below this and report the legal identity of his or her business on the “Company Name” line.  The Subcontractor must now read through this paperwork and determine whether it fully defines the working arrangement he or she intends to engage in with the Contractor. If so, then the Subcontractor must sign and date this contract on the “Subcontractor’s Signature” line and “Date” line respectively. This entity will also need to provide his or her printed name and professional name on the “Print Name” and “Company Name” line.

The Subcontractor must now read through this paperwork and determine whether it fully defines the working arrangement he or she intends to engage in with the Contractor. If so, then the Subcontractor must sign and date this contract on the “Subcontractor’s Signature” line and “Date” line respectively. This entity will also need to provide his or her printed name and professional name on the “Print Name” and “Company Name” line.